We have all heard a friend or colleague share their story of when they bought a hot stock right before it doubled. Is this a once in a lifetime event or can it be repeated effortlessly time and time again?

As Warren Buffet once said “The stock market is designed to transfer money from the active to the patient.” Investors that stay invested outperform over time. Nobody can exactly predict a stock’ s future price but that doesn’t stop many attempting to do exactly that. Study after study has shown that trying to beat the market simply does not work.

If you were fully invested in the S&P 500 over the last 15 years your return would have been 9.88%. If you missed just the 10 best days your return drops to 4.31%. Since it is impossible to predict which will be the market’s best days it is important to stay fully invested.

What Is Market Timing?

“Market timing” simply means buying a security with the expectation of selling it at a higher price in the short term. Market-timing investors are essentially trying to “beat the market” by choosing the right time to buy and sell.

While market timing may initially seem to be a variant of the popular saying “buy low, sell high”, the fact that the future is uncertain and that stock prices change rapidly, means that it is basically impossible to accurately and consistently determine when a security has hit its lowest or highest point.

What Does Time In The Market Mean?

“Time in the market” means you are consistently investing over time and not trying to guess the market’s highest or lowest point. There may be times when you buy at a high point but you know that long term will not have much of an impact on your returns. In other words, you have a long-term buy and hold strategy.

This strategy works because dating back to 1957, negative 10- year returns have been extremely rare with only two occurrences. If you are focused on a 10 year or more period it is unlikely that you will end up with negative returns.

The average long-term return on the S&P 500 is 10%. However, it’s important to remember this is an average and returns can vary greatly from year to year.

Top 5 Reasons Time In the Market Is More Effective

1. No One Has A Crystal Ball

Simply put, nobody can predict the stock market. There is never a ‘sure thing’ so don’t trust a friend, neighbor, or financial advisor that tells you otherwise. Trying to predict stock market prices ends up costing small investors.

In fact, studies estimate that as many as 97% of retail investors lose money from actively day trading in the stock market!

2. Compounding Works To Your Advantage

Buying stocks for the long term allows you to take advantage of compounding. Compounding is the ability to reinvest your profits over time to generate even greater profit potential. Time is your greatest friend as an investor, and being able to reinvest a dividend can make a major difference in your wealth.

As an example, simply pocketing a 3% yield will double your money about every 33 years. If reinvested back into more shares of the same stock, your investment would double in almost 10 fewer years!

3. You’ll Pay Less In Taxes

Another advantage of long-term investing is that you’ll pay far less in taxes than if you’re an active trader. Short-term traders, or those who own their investments for less than a year, pay tax at their top marginal tax rate.

This could be anywhere from 10% to 39.6%. Long-term capital gains taxes are either 0%, 15%, or 20% at the highest, depending on your income. No matter how you look at it, holding your stocks for longer than a year saves you money come tax time.

4. Frequent Trading Can Be Expensive

Frequent trading and trying to time the market will also rack up brokerage commission costs, particularly for smaller investors. While the costs for a broker to execute a trade may be relatively low on a trade-by-trade basis, someone who trades frequently can see these fees & costs add up over time and make a significant dent in their investment returns.

5. Your Emotions Shouldn’t Be Involved

People that monitor stock prices too closely tend to make emotional decisions. For example, if you purchase an investment and see that there is a gain you may be tempted to sell too quickly to lock in a small profit.

This goes against the original reason that you selected the investment thinking that it had good long-term potential. On the flip side if you see a loss you may panic and sell, locking in a loss.

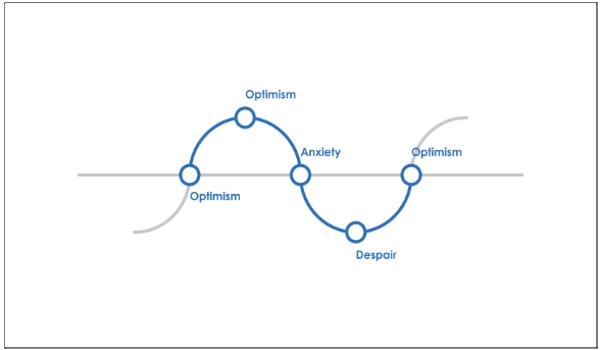

Emotional swings when the market rises and falls.

Market timing easily plays on our emotions in a way that overrides good decision making. If the reasons for your investment change, then it is important to be willing to change your investments.

For example, if you are saving a new home and the time to purchase that home is getting closer it would be wise to sell the investment. Market timing might tell you otherwise.

Focus On Your Long Term

Choosing the same investment approach as your friend or co-worker does not make sense. Their goals, time horizon, and purpose for the investment are different from yours. You have long term goals, you’re investing should follow the same rule.

The first step of the investment process is to get a clear idea of what your goals and time frame to accomplish them are. Once you do this, it should become clear that the goal is not to “beat the market” but rather to reach or exceed your personal goals such as retirement or saving for a child’s education.

A diversified portfolio of investments that are held for a number of years has historically proven to provide greater returns than those who try to jump in and out of the market at what they believe are the lows and highs.